Generative AI is Dominating Investments, Including in Securities

I have been diving into the insightful Artificial Intelligence Index Report 2024 by Stanford University 1, and its coverage of AI trends across the market is truly outstanding.

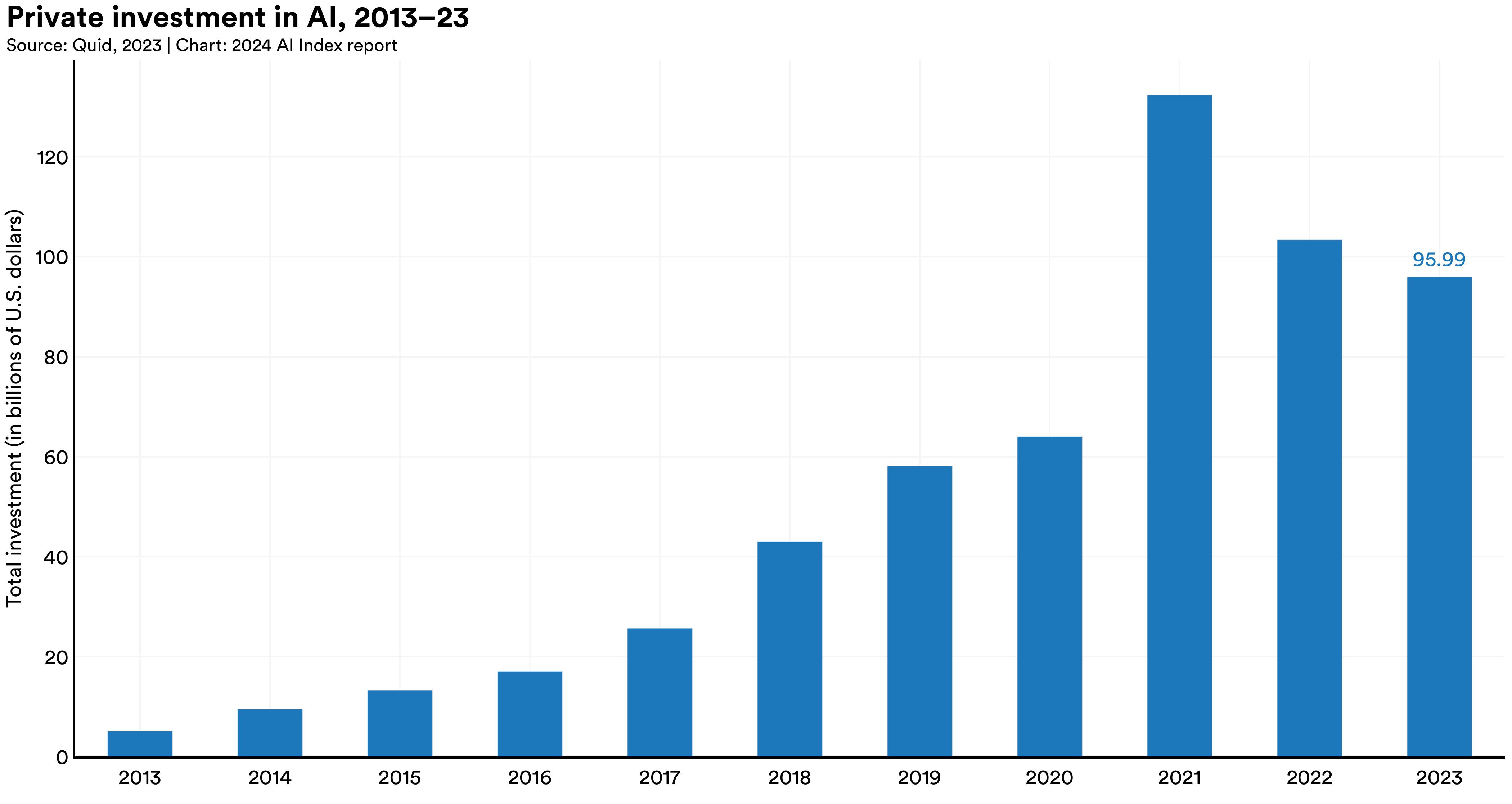

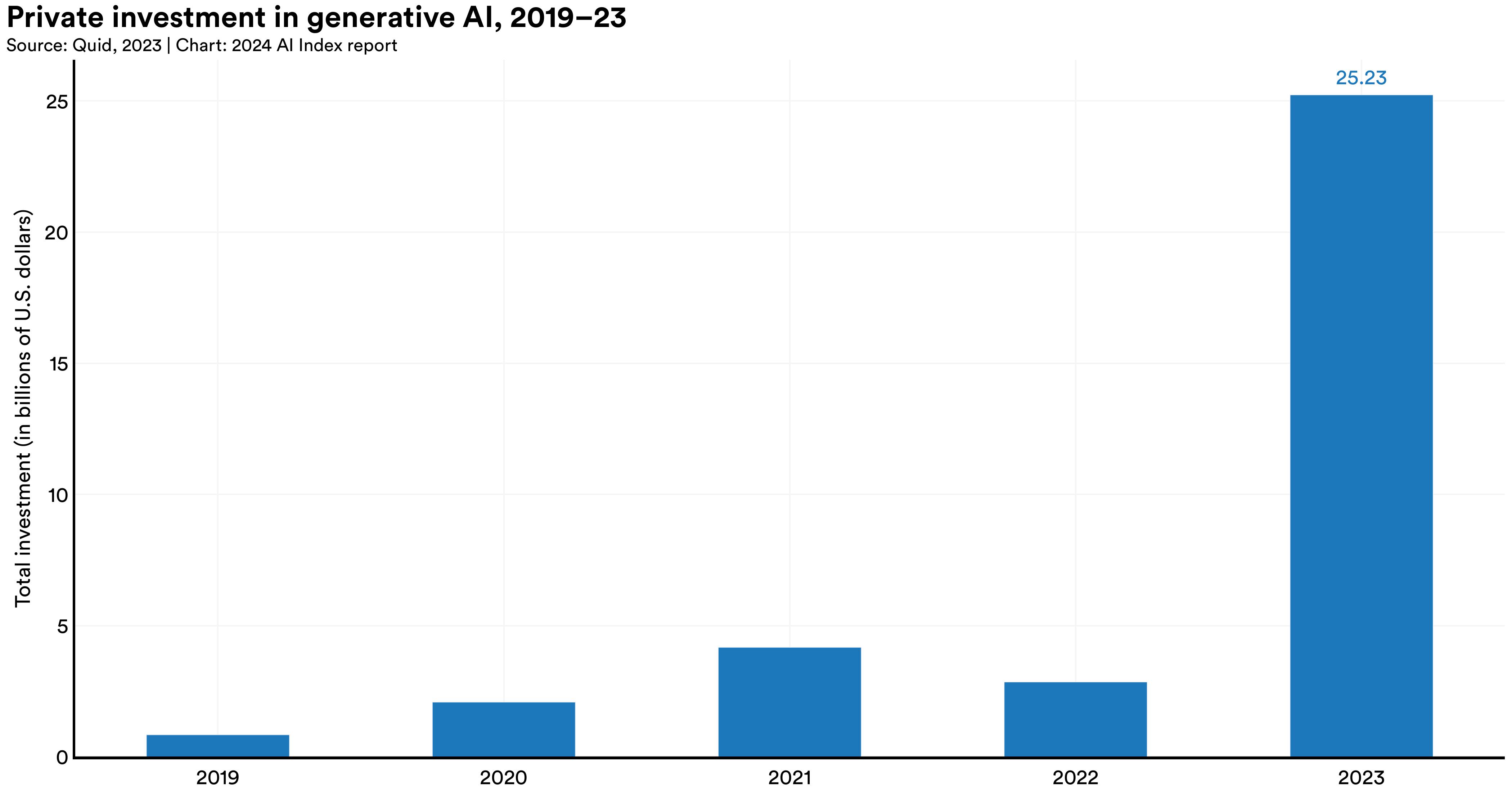

One standout takeaway from Chapter 4 on the Economy, particularly Section 4.3 on AI investment trends, is that investments in generative AI are soaring despite an overall decline in private AI investments. This might seem surprising given the widespread media coverage of AI across all applications, but the data speaks for itself:

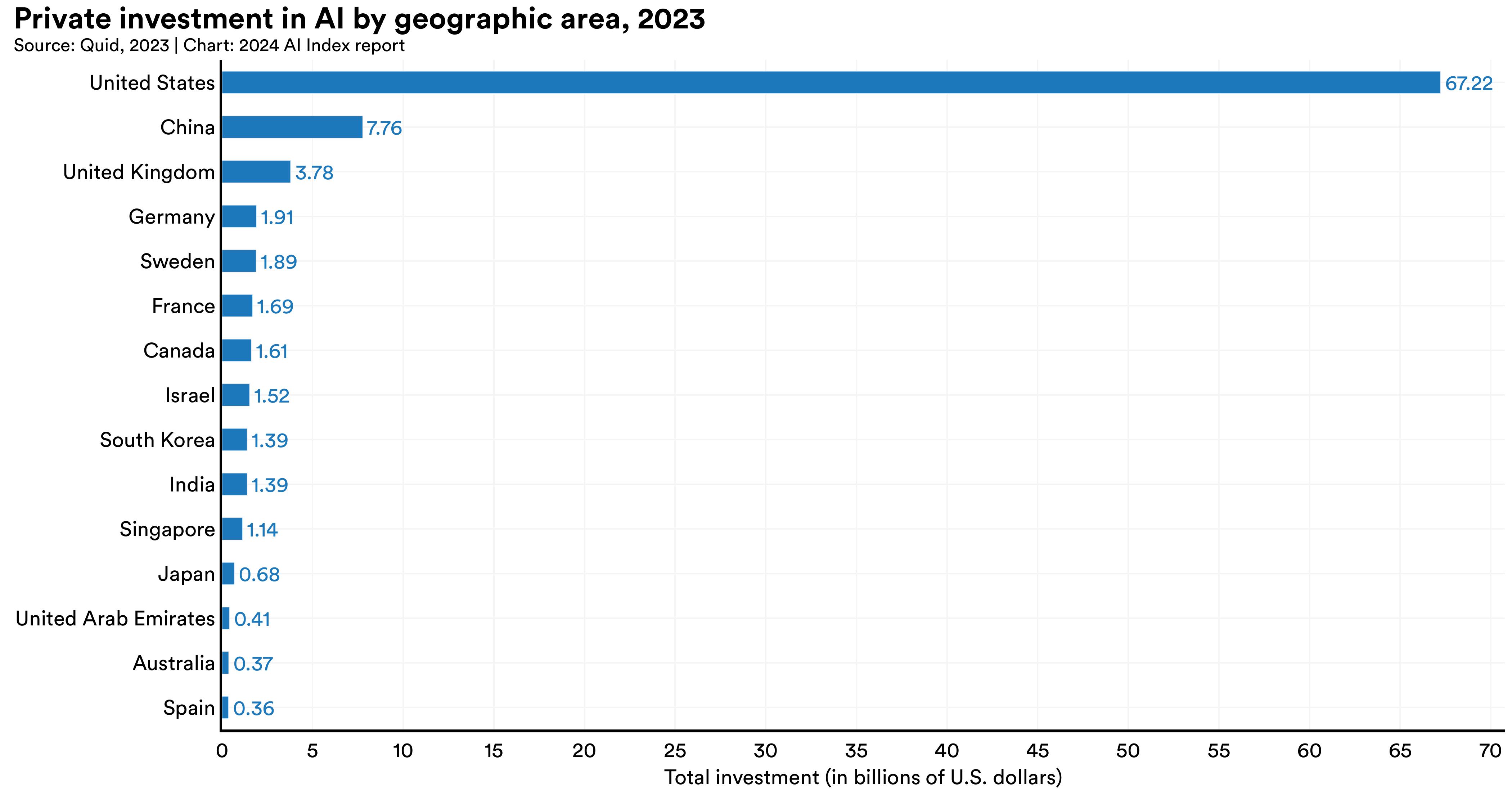

The US are leading this race with a staggering $67.2 billion in AI investments in 2023. That’s roughly 8.7 times more than China’s $7.8 billion and 17.8 times more than the UK’s third place $3.8 billion.

1 Interestingly, this trend is mirrored in the financial markets

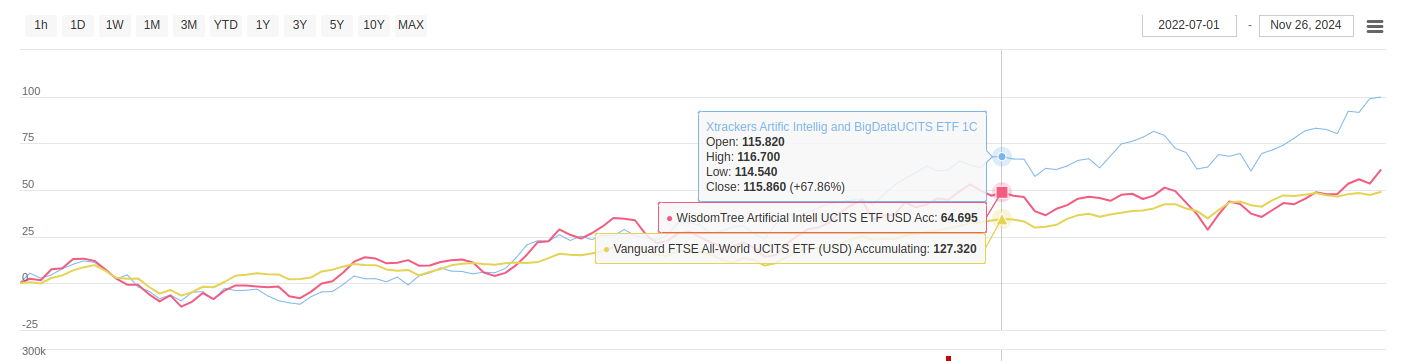

Tracking different AI-focused ETFs, it’s clear that the market’s enthusiasm for generative AI and its transformative potential is strong.

For instance, the performance disparity between ETFs like Xtrackers Artificial Intelligence & Big Data UCITS and WisdomTree Artificial Intelligence UCITS reflects the current investment trends favoring big tech companies in generative AI.

-

Xtrackers Artificial Intelligence & Big Data UCITS tracks the performance of the Nasdaq Global Artificial Intelligence and Big Data Index. The fund portfolio focuses on companies involved in Deep Learning, NLP, Image Recognition, Speech Recognition & Chatbots, Cloud Computing, Cybersecurity and Big Data therefore large-cap tech giants like Microsoft, Apple, NVIDIA, Oracle, and Meta, which have seen substantial growth due to their significant investments in AI technologies. This ETF has performed exceptionally well over the past three years, thanks to these tech titans.

-

On the other hand, the WisdomTree Artificial Intelligence UCITS ETF tracks the performance of a different index, the Nasdaq CTA Artificial Intelligence Index which includes companies engaged in the artificial intelligence segment of the technology, industrial, medical and other economic sectors. So, without excluding the titans, it has a greater focus on applied AI with companies like Symbotic (supply chain), Upstart (lending marketplace), Cadence (electronic systems design), Mobileye (advanced driver assistance), Ocado (logistics), Illumina (DNA sequencing), CCC Intelligent Solutions (Property and Casualty Insurance). While these companies are important players in the AI space, their performance hasn’t matched the rapid growth seen in the big tech sector.

Here’s a comparison between the two funds over the period from July 1, 2022, to November 26, 2024, with the y-axis displaying % variation.2 To add perspective, I included the Vanguard FTSE All-World UCITS ETF, which represents the performance of large and mid-cap stocks across geographies and a wide array of sectors, from telecommunication to banks, from industrial goods and services to travel and leisure. Its performance is also noteworthy. 3

It’s fascinating to see the dynamics of investment trends in such a transformative field as AI. The robust performance of ETFs focused on big tech companies underscores the significant role generative AI is playing in shaping the future. It also highlights the importance of staying informed about sector-specific trends when making investment decisions. Not all that glitters is gold.

-

Artificial Intelligence Index Report 2024

Nestor Maslej, Loredana Fattorini, Raymond Perrault, Vanessa Parli, Anka Reuel, Erik Brynjolfsson, John Etchemendy, Katrina Ligett, Terah Lyons, James Manyika, Juan Carlos Niebles, Yoav Shoham, Russell Wald, and Jack Clark, “The AI Index 2024 Annual Report,” AI Index Steering Committee, Institute for Human-Centered AI, Stanford University, Stanford, CA, April 2024.

The AI Index 2024 Annual Report by Stanford University is licensed under Attribution-NoDerivatives 4.0 International ↩︎ -

Made with the tools provided by DeGiro platform ↩︎

-

Disclaimer: The information provided in this post is for informational purposes only and does not constitute financial advice. The views expressed are my own and are based on data and trends within the AI market. Readers should perform their own research and consult with a qualified financial advisor before making any investment decisions. ↩︎